MALSPIEL IM MALORT

Beim Malen im Malort werden keine (Kunst-)Werke hergestellt. Das Malspiel geschieht um seiner selbst willen, als ein Ausfließenlassen im Augenblick, das keiner nachträgliche Bewertung oder Deutung bedarf. Unter diesen Bedingungen werden beim Malen nicht nur Erlebnisse, Gefühle und Empfindungen sichtbar. Über alles Beabsichtigte hinaus kommt auch zum Ausdruck, was in der organischen Erinnerung gespeichert wurde. Es kann nur auf diesem Weg geäußert und damit integriert werden. So entfaltet sich ein heilsamer Prozess, der Wohlbefinden erzeugt und die Persönlichkeit stärkt.

Innerhalb der mit farbigen Spuren übersäten Malwände sind die Malenden von Beobachtung und Ablenkung durch die Außenwelt abgeschirmt. Der Malort bietet eine vorbereitete Umgebung, die das Malen für alle leicht macht. Der eigens entwickelte Palettentisch mit 18 hochwertigen Gouachefarben und besten Naturhaarpinseln bildet den Mittelpunkt des Raumes.

Gemalt wird frei stehend auf an der Malwand befestigten Papierbögen. Das bedingt eine fortwährende Pendelbewegung zwischen Malwand und Palettentisch und bezieht den gesamten Körper in den Malprozess mit ein.

KURSE

Der Malort Kuchl bietet wöchentliche Malgruppen für Menschen von 3 bis 99 Jahren:

+ für Kleine ab 3 Jahren, die im spontanen Spiel die eigene Spur entwickeln.

+ für Größere, die im Spielraum des Blattes eine Welt nach Maß inszenieren.

+ für Große, die einen Ausgleich zu der heute vorherrschenden Leistungsgesellschaft finden.

+ für Eltern, die gemeinsam mit ihren Kindern einen Raum zur Entfaltung suchen.

Der Malort Kuchl orientiert sich an den Erkenntnissen und Erfahrungen Arno Sterns.

Das Malspiel wird betreut von Irmgard und Peter Ganzer

Die Malgruppen sind offen für jeden und geeignet für Menschen ab 3 Jahren.

Es besteht die Möglichkeit, dass Eltern und Kinder gemeinsam teilnehmen.

Kurse finden wöchentlich und fortlaufend statt.

Eine Maleinheit dauert 1,5 Stunden.

Da eine ganze Maleinheit für kleinere Menschen erfahrungsgemäß oft noch zu lange ist,

wird für sie ein geringerer Kursbeitrag nach Absprache verrechnet.

Die Anmeldung erfolgt spätestens mit Kursbeginn.

Bei späterem Kurseintritt wird der Beitrag anteilig verrechnet.

Für alle Neueinsteiger gibt es vor Kursantritt ein unverbindliches Erstgespräch nach telefonischer Vereinbarung.

AKTUELLE ANGEBOTE

Malspiel 2024

Donnerstag Nachmittag

mit Irmgard Ganzer

(Wochentag wird bei Kursstart fixiert)

15.00 bis 16.30 Uhr

3. Oktober 2024

bis 27. März 2025

(wöchentlich)

20 Maleinheiten zu je 1,5 Stunden

Preis pro Maleinheit: € 18,50 (inkl. 20 % Mwst.)

(inklusive Farbe und Material)

Mind. Teilnehmer: 5

Max. Teilnehmer: 10

ÜBER UNS

Nach einem Intensivseminar im Juni 2014 bei Arno Stern in Paris haben wir mit viel Freude den Malort Kuchl eingerichtet.

Wir wollen Menschen aus unserer Umgebung ermöglichen, in diesem geschützten Raum das Malspiel zu erleben und ihre „Spur“ zu finden bzw. wieder zu entdecken.

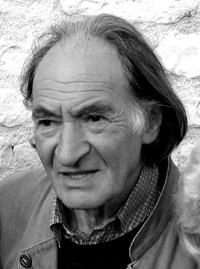

ARNO STERN

„Kinder sollen das Leben ernst nehmen, sagt man. Dabei sollte gerade das Spielen ernst genommen werden.“ Arno Stern

man. Dabei sollte gerade das Spielen ernst genommen werden.“ Arno Stern

Arno Stern, 1924 in Kassel geboren, ist ein von der UNESCO anerkannter Pädagoge und Forscher. Seit mehr als 60 Jahren übt er die dienende Rolle im von ihm erfundenen „Malort” in Paris aus.

Arno Stern besucht drei Jahre lang die Schule in Kassel, bevor er mit seinen Eltern nach der Machtergreifung Hitlers nach Frankreich emigriert. Nach Ausbruch des 2. Weltkriegs flüchtet die Familie weiter in die Schweiz. Arno Stern verbringt dort bis zum Ende des Krieges seine Jugendjahre in einem notdürftig umgestalteten Fabrikgebäude. Nach Jahren der Internierung und Staatenlosigkeit kehrt Arno Stern mit seiner Familie nach Frankreich zurück. 1946 arbeitet Stern in einem Kinderheim in einem Pariser Vorort. Sein Auftrag ist, 150 Kriegswaisen zu beschäftigen. Ohne Vorstellung von seiner Aufgabe lässt er die Kinder malen. Bereits die ersten Erfahrungen machen ihm die Wichtigkeit dieses Spiels bewusst – und auch, dass es dafür geeigneter Bedingungen bedarf. So erfindet er eine besondere Einrichtung, den Palettentisch und die schützenden Wände: Der „Malort” (franz. Closlieu) entsteht, der schützende Raum für das Malspiel.

In den sechziger Jahren unternimmt Arno Stern Reisen in ferne Länder, um die Universalität des von ihm Entdeckten nachzuweisen: Menschen in Paris, Nomaden in der afrikanischen Wüste oder Urwaldbewohner zeichnen ausnahmslos dieselben Gebilde, obwohl weder ihre Hautfarbe, noch ihre Kultur oder ihre Umgebung die geringste Ähnlichkeit aufweisen.

Diese Entdeckung zeigte, dass alle Menschen unabhängig von Alter oder Wohnort beim Zeichnen oder Malen Zugang zum genau gleichen Fundament finden, vorausgesetzt sie werden vor fremden Einflüssen geschützt und von der Gewohnheit befreit, die gezeichnete Spur mit Kunst zu verwechseln. Dieses Fundament, das Arno Stern „die Formulation” nennt, besteht aus 70 „Zeichen”, die er im Lauf von mehr als 60 Jahren entdeckt und studiert hat.

Seit mehr als 30 Jahren gibt Arno Stern in vielen Ländern Seminare und Ausbildungskurse. Er hat zahlreiche Bücher über seine Arbeit in verschiedenen Sprachen veröffentlicht.

Am 9. September 2019 wurde Arno Stern von der UNESCO und von der Pariser Sorbonne geehrt.

Arno Stern verstarb am 30. Juni 2024 im Alter von 100 Jahren.

KONTAKT

Malort Kuchl

Markt 171

5431 Kuchl

Irmgard Ganzer

Peter Ganzer

Für Fragen und Terminvereinbarungen können Sie uns gerne telefonisch oder per E-Mail kontaktieren.